2025 North Dakota Health Care Professional Student Loan Repayment Program

application cycle has CLOSED.

Please review the additional resources below to assist in successfully applying for the ND Health Care Professional Loan Repayment Program.

- Application checklist (Items to gather/review before applying)

- Employer Endorsement and Financial Commitment Form (NOTE: Form not required for initial application. HHS will contact applicant if selected.)

- ND Century Code for ND Health Care Professional Loan Repayment Program

- Shortage Designation Maps

- Tax Information on Loan Repayment Programs

PROVIDER ELIGIBILITY

The applicant must:

- practice in a specialty that is needed in the area for which they have applied and be available to begin by July 1 of the contract year;

- accept Medicare and Medicaid assignments;

- be employed full-time providing direct patient care in the appropriate settings, no more than 8 hours of a full-time provider’s weekly hours will be spent on administrative duties, and/or serving as a clinical preceptor; and telehealth providers must live in North Dakota; and

- be physically present and provide services on at least a half-time basis at one entity that meets the site requirements and provide telehealth services to a second entity meeting the site requirements. Services at both entities combined must meet the full-time requirement defined above.

ELIGIBLE PROFESSIONS

- Physicians (MD/DO)

- Family Medicine, Internal Medicine, Pediatrician, Obstetrics & Gynecology

- Primary Care Nurse Practitioner (DNP, NP), Physician Assistant (PA), Certified Nurse Midwife (CNM), Certified Registered Nurse Anesthetist (CRNA)

- Clinical Psychologist (PhD)

- Registered Nurse (RN)

- A behavioral health professional means an individual who practices in the behavioral health field and is:

- A licensed addiction counselor (LAC)

- A licensed professional counselor (LPC)

- A licensed social worker (LSW)

- A registered nurse (RN)

- A specialty practice registered nurse

- A behavioral analyst (BA)

SITE ELIGIBILITY

Site eligibility is based on the following criteria:

- number of health care professionals, by specified field, already providing services in the area;

- access to health care services in the area;

- the level of support from the area; and

- sites that meet the matching funds requirement.

Priority is given to sites that:

- are in a federally designated Health Professional Shortage Area (HPSA) or a state-defined critical shortage area; or

- are located at least twenty miles outside the city limits of a city having more than forty thousand residents.

INCENTIVE AND PAYMENT

Providers participating in the loan repayment program can enter into an agreement to practice up to five years and receive the following loan repayment assistance for outstanding educational loans from institutional lending agencies of the United States, Canada or other approved countries.

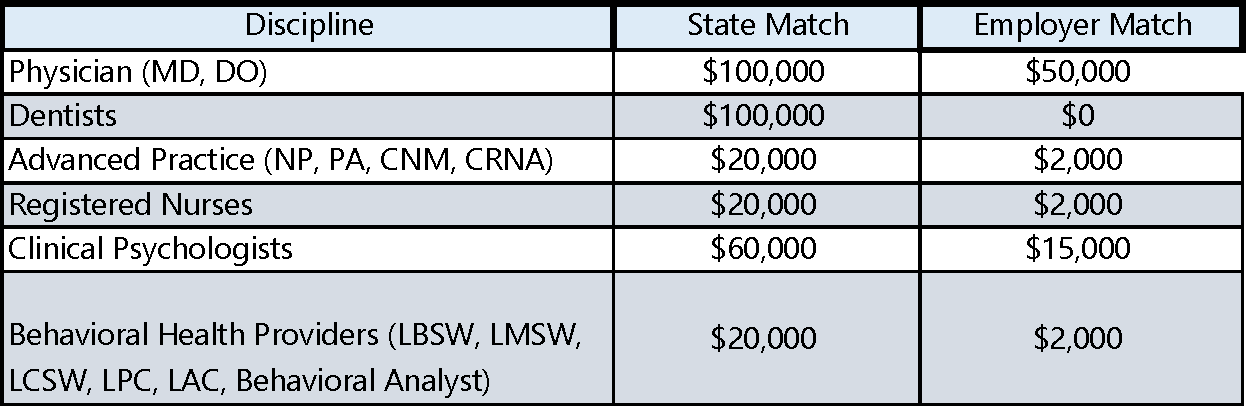

The table below identifies the funding for each discipline:

TAX INFORMATION

The funds paid by the facility/community organization and the North Dakota Department of Health (federal funds) are all tax free, according to the ND Health Care Professional Loan Repayment Tax Information.

- IRS Publication 970 states the following regarding student loan repayment assistance programs "Student loan repayments made to you are tax free if you received them for any of the following:

- The National Health Service Corps Loan Repayment Program.

- A state education loan repayment program eligible for funds under the Public Health Service Act.

- Any other state loan repayment or loan forgiveness program that is intended to provide for the increased availability of health services in underserved or health professional shortage areas (as determined by such state).

- You cannot deduct the interest you paid on a student loan to the extent payments were made through your participation in the above programs."

- Payments under certain state loan repayment programs.

- In the case of an individual, gross income shall not include any amount received under section 338B(g) of the Public Health Service Act, under a state program described in section 338I of such Act, or under any other state loan repayment or loan forgiveness program that is intended to provide for the increased availability of health care services in underserved or health professional shortage areas (as determined by such state).

- Under 26 U.S.C. § 3401(a) (19), state loan repayment program payments are also not considered to be "wages" and are therefore exempt from federal employment tax (FICA).

- Wages

- For purposes of this chapter, the term "wages" means all remuneration (other than fees paid to a public official) for services performed by an employee for his/her employer, including the cash value of all remuneration (including benefits) paid in any medium other than cash; except that such term shall not include remuneration paid.

- For any benefit provided to or on behalf of an employee, if at the time such benefit is provided, it is reasonable to believe that the employee will be able to exclude such benefit from income under section 74(c), 108(f)(4), 117, or 132.

SELECTION OF APPLICANTS

- The North Dakota Department of Health and Human Services (ND HHS) shall establish criteria to be used in selecting health care professionals for participation in a student loan repayment program. The criteria must include:

- The health care professional's specialty;

- The need for the health care professional's specialty within an area;

- The health care professional's education and experience;

- The health care professional's date of availability and anticipated term of availability; and

- The health care professional's willingness to accept Medicare and Medicaid assignments, if applicable.

- In selecting health care professionals for participation in the program, ND HHS shall require that the individual:

- Is physically present at and provides services on a full-time basis to an entity that meets the requirements of section 43-12.3-04; or

- Is physically present at and provides services on at least a half-time basis to an entity that meets the requirements of section 43-12.3-04;

- Provides telehealth services to a second entity that meets the requirements of section 43-12.3-04; and Page No. 1

- Verifies that the services provided under paragraphs 1 and 2 are equal to the full-time requirement of subdivision a.

- Is physically present at and provides services on a full-time basis to an entity that meets the requirements of section 43-12.3-04; or

- In selecting health care professionals for participation in a program, ND HHS may consider an individual's:

- Length of residency in this state; and

- Attendance at an in-state or an out-of-state institution of higher education.

CONTRACT OBLIGATIONS

The ND Department of Health and Human Services (ND HHS) shall enter a contract with a selected health care professional. ND HHS shall agree to provide student loan repayments on behalf of the selected health care professional subject to the requirements and limitations of this section.

- For a physician:

- The loan repayment may not exceed twenty thousand dollars per year, and may not exceed one hundred thousand dollars over five years; and

- The matching funds must equal fifty percent of the amount required in paragraph 1.

- For a clinical psychologist:

- The loan repayment may not exceed twelve thousand dollars per year and may not exceed sixty thousand dollars over five years; and

- The matching funds must equal twenty-five percent of the amount required in paragraph 1.

- For an advanced practice registered nurse or a physician assistant:

- The loan repayment may not exceed four thousand dollars per year and may not exceed twenty thousand dollars over five years; and

- The matching funds must equal ten percent of the amount required in paragraph 1.

- For a behavioral health professional:

- The loan repayment may not exceed four thousand dollars per year and may not exceed twenty thousand dollars over five years; and

- The matching funds must equal ten percent of the amount required in paragraph 1.

- For purposes of this section, a behavioral health professional means an individual who practices in the behavioral health field and is:

- A licensed addiction counselor;

- A licensed professional counselor;

- A licensed social worker;

- A registered nurse; or

- A specialty practice registered nurse.

- A behavioral analyst

- Payments under this section must be made on behalf of the health care professional directly to the Bank of North Dakota or to another participating lending institution.

- Except as otherwise provided, payments under this section may be made only at the conclusion of each twelve-month period of service.

- Prorated payments may be made only if:

- The repayment of the loan requires less than a full annual payment;

- The health care professional is terminated or resigns from his or her position; or

- The health care professional is unable to complete a twelve-month period of service due to the individual's death, a certifiable medical condition or disability, or a call to military service.

- Payments under this section terminate upon the earlier of:

- The full repayment of the health care professional's student loan; or

- The completion of five years as a participant in the student loan repayment program. ND HHS shall waive the requirements of this section that pertain to matching funds if the health care professional opens a new practice as a solo practitioner in a city that has fewer than 15,000 residents

EMPLOYER MATCH

An employer match is REQUIRED for this program. Applicants must secure contributions toward their contracts, amounts vary by discipline.

Discipline Awards + Employer Match:

- Physicians - $100,000 state funds + 50% employer match

- Advanced Practice Providers (DNP, NP, PA, CNM, CRNA) - $20,000 state funds + $2,000 employer match

- Registered Nurses (RN) - $20,000 state funds + $2,000 employer match

- Clinical Psychologists - $60,000 state funds + $15,000 employer match

- Behavioral Health (LBSW, LMSW, LCSW, LPC, LAC, RN, Behavioral Analyst) - $20,000 state funds + $2000 employer match